estate tax changes in reconciliation bill

The Build Back Better Framework released. Under the proposal for tax year 2022 individuals could face a 464 combined tax rate on ordinary income a 396 ordinary rate plus 38 net investment income tax or self.

Everything In The House Democrats Budget Bill The New York Times

Estate and gift tax exemption.

. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most of the proposed changes to the estate tax. Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. Trust Estate Strategies Protected in New Tax Proposal November 15 2021 The new reconciliation bill that was introduced in the House of Representatives eliminates some of.

The proposal reduces the exemption from estate and gift taxes from. Growth and Tax Relief Reconciliation Act of 2001 EGTRRA. Estate is 16000000 Exemption 1000000.

This is estimated to bring in 230 billion over 10 years. Some of the changes most likely to impact clients include. All major provisions of the House Ways Means Committees budget reconciliation tax bill would cut 2022 taxes on average for households making 200000 or.

Under current law a 38 tax is imposed on Net Investment Income NII. Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act. The bill is over 800 pages long and contains a myriad of other tax law changes.

The current 117M1 estate and gift tax exclusion was provided under a temporary law. It would apply a 5 rate above income of 10 million with an additional 3 surtax on income above 25 million. Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be.

Thursday 04 November 2021. Estate planning changes dropped from US budget reconciliation Bill. Gift in 2021 of 11000000.

In this summary some key provisions of the proposal are highlighted including the tax rates on long-term capital gains and trusts and estates elimination of valuation discounts for passive. Death in 2022. The amended change would raise the cap to.

Instead it contains three primary changes affecting estate and gift taxes. The House budget reconciliation bill HR. Effective January 1 2022.

Increases to the income tax rates. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. 5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for.

The giftestate tax exemption currently is 10 million adjusted for inflation 117 million in 2021. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain.

Estate Tax 15000000 X 40 6000000. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget. Take note of these revenue offsets and their potential effective dates.

A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million. Even without any act of Congress the exclusion will be cut in half effective. As we write this commentary Congress and the White House are negotiating over proposed legislation which if enacted in its current form would significantly change tax laws.

Potential Tax Impact on Estate Planning. Five Tax Implications of the Budget Reconciliation Bill for Retirement Savers. The latest draft of the US Congress budget reconciliation Bill omits most of.

Net Investment Income Tax Expanded 138203. The Legislation includes significant tax proposals that if passed will dramatically change the tax and estate planning landscape for high-income and high-net worth individuals. It is scheduled to revert to 5 million plus inflation in 2026.

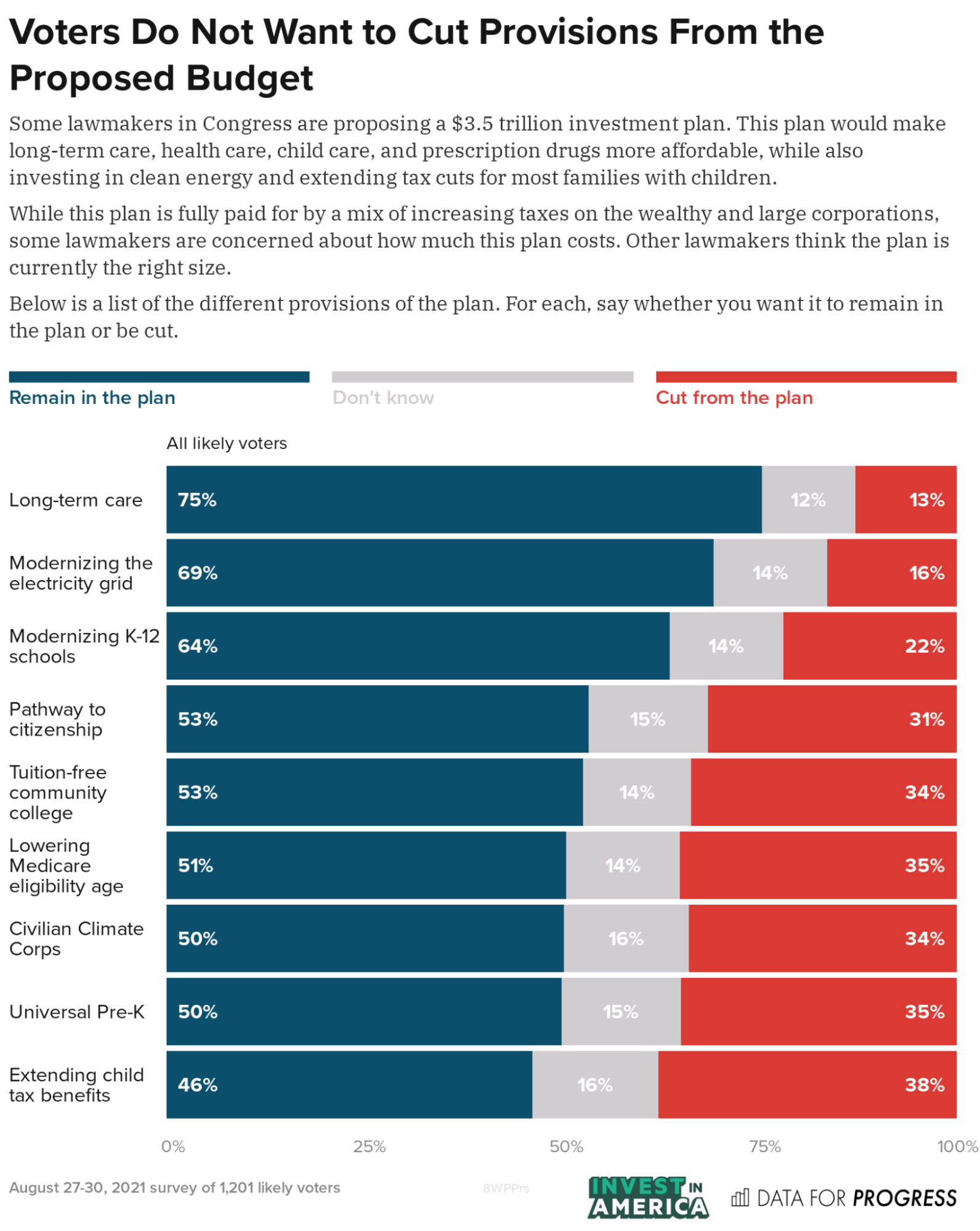

Voters Support All Provisions Of The 3 5 Trillion Build Back Better Bill

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

Why Democrats 3 5 Trillion Reconciliation Bill Is A Losing Game The Hill

Us Corporations Talk Green But Are Helping Derail Major Climate Bill Climate Policy Climates Corporate

Bill Statement Ambit Energy Ambit Energy Energy Free Energy

Voters Support All Provisions Of The 3 5 Trillion Build Back Better Bill

Everything In The House Democrats Budget Bill The New York Times

Biden S Spending Bill Details What S In And What S Out So Far Npr

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

Hiltzik Biden S Budget Reconciliation Bill And Climate Change Los Angeles Times

Nancy Pelosi Rejects Manchin S Call For A Pause Shows Little Willingness To Pare Back 3 5 Trillion Bill Cnnpolitics

The Democrats Have A Lot Of Cutting To Do The New York Times

Senate Draft Of Build Back Better Reconciliation Bill Currently Stalled By Sen Manchin Would Finance Nearly 1 Million Affordable Homes Over 10 Years Novogradac

Property Tax Breaks Would Be Restored Under Senate Budget Bill Menendez Says Nj Com

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

Senate Draft Of Build Back Better Reconciliation Bill Currently Stalled By Sen Manchin Would Finance Nearly 1 Million Affordable Homes Over 10 Years Novogradac

House Panel Advances Key Portion Of Democrats 3 5t Bill The Hill